Nearly 12 months ago I wrote a blog about brands. I had good intentions of posting the follow up within a few weeks however things have been spiralling fast in the exciting brand development at Select Medical! We now have OLA, Simpulse and Pure Air operating at different price points, which offer a greater degree of flexibility for all stakeholders.

Hopefully you will have read about the launch of our Extra Care range too, which I think serves as a good case study of how brands can understand the needs of all of its stakeholders and develop a range of products to meet a particular market segment. I spent many years working with retailers and brand marketers developing ranges based on market segmentation and consumer insights, however, doing this in a completely different industry was exciting if not challenging!

In my previous blog I asked “where are brands in the pressure area care arena?” In many respects the answer to this question is easy because they’re everywhere; on the surface, anyway. The point I was trying to illustrate, and what has become more apparent the longer I have spent in this space, is that slapping a pretty sticker on a product and buying lots of advertising space does not make a brand. In my last article I talked about brand leaders understanding the needs of their customers, shoppers and consumers, and then developing brands from that learning. And on much reflection, this point is even more relevant in pressure care than I originally perceived.

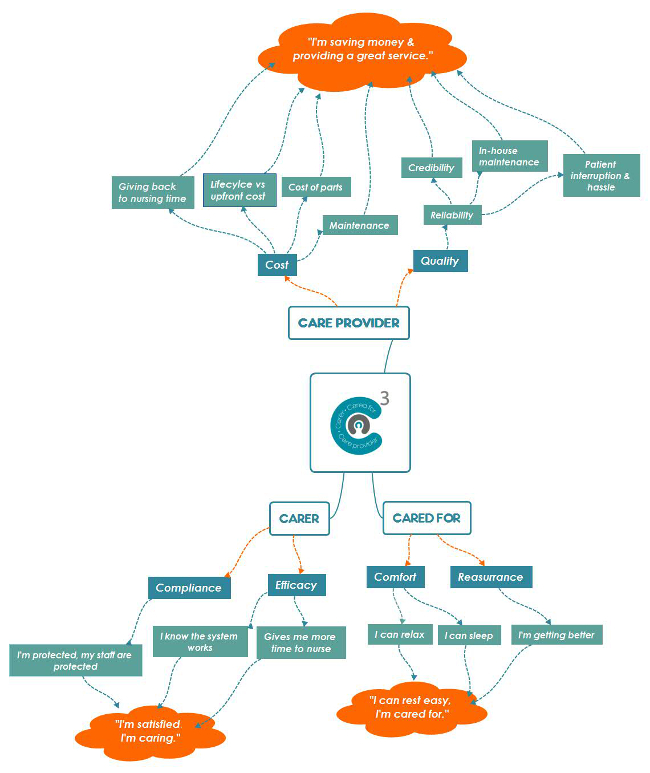

At Select Medical we have been doing a lot of work on this theme and initially this led to the creation of our C3 approach. Substituting the typical model of ‘Buyer’, ‘Shopper’ and ‘Consumer’, often used in the retail sector, we’ve focused on the ‘Care Provider’, ‘Carer’ and ‘Cared for’. We have thought about how these different needs manifest themselves in what each of these stakeholders want from our services and products.

I find it fascinating, in an industry where the various stakeholders in each group have such vastly different needs, that the industry has not created brands to deal with this. The buying profiles of Community loan store managers, Group purchasing directors, Independent care home managers etc, are all completely different.

Carers are vastly different in this space too, from the super experienced TVN’s to dedicated care home assistants, or even family members caring for a loved one in their home…features, benefits and ease of use become really important considerations.

And then there’s the cared for. Here the differences are enormous, and it’s easy to say “give the cared for the best in every environment”, however, the financial reality of some of the settings PAC equipment finds itself in, just doesn’t allow for this. This insight led to the development of our OLA range. But of course while efficacy cannot ever be substituted, we can play tunes with balancing upfront costs with long-term value for money. We can dial up the technology that makes comfort and well-being more of a priority, where those needs trump the value discussion! That is why you will see more features within our leading brand Pure Air.

Great brands start by tapping into a consumer insight and developing a product that fulfils this need or, more subtly, developing attributes within a product that fulfils this need. Lynx is a great example of this, coming from nowhere in the male deodorant market to near market domination! They tapped into a need for young men to be ‘cool’ and ‘attractive’. Dyson, on the almost polar opposite scale, tapped into an equally powerful emotion that we want to do the ‘best by our families’, making sure the house is as clean as possible. This insight helped them create a ‘super technical’ gadget that would outperform everything on the market, targeted toward a specific segment of people with a specific need. Hoover like Sure still sell their product, but to a different bunch of people and almost definitely at a lower price than before their rivals came to bear. Are we seeing something similar closer to home in pressure care…? I believe I’m witnessing similar changes, where disruptive ‘brands’ are offering ‘something’ different than the established heritage manufacturers. We are proud to be both a part of this change and supporting others to do the same…

In any case, having tried to understand what the market needs, you then have to understand ‘who in that market needs it? In the consumer world manufacturers, or should I say brands, invest heavily in segmenting their markets and usually one will find themselves placed in seven or eight convenient pots. These will range from a group who is passionate about what you sell and have loads of cash, to someone who doesn’t really understand your offer and is skint! This folks is segmentation in a paragraph, so there are some holes in it… but think about this in relation to PAC. 30 minutes surfing the web will tell you that pressure care is largely grouped by technology; statics, dynamics or hybrids. Then type; full replacement or overlay and if you are lucky there may be a range for bariatric service users. Usually though, still all under one tab of pressure care. Do we really believe this fits ‘everyone’s’ very different needs…???

At Select Medical we don’t think so and it is this approach that drives our belief that C3 will benefit everyone! When we talk about everyone we talk about the Care provider, Carer and Cared for…

About the author – David Elstone

David Elstone is Managing Director at Select Medical. His professional background, of over 15 years, covers operational activites and marketing within the FMCG industry for a global hygiene market leader. David has a strong appetite for operational excellence and a fervour for what makes consumers passionate about brands.